Fix the Leaks

How much water are we losing from leaks?

As we prepare to endure another year of water restrictions, and risk of forest fire, that we may not be able to fight without water bombers, how much of our precious resource is washing out to shore from Non-Revenue Water Loss? This is water lost through the distribution system before it reaches a paying customer.

The Canadian Water and Wastewater Association (CWWA) completed a study in 1997 to estimate the investment needs in water and wastewater infrastructure over the period 1997-2012. This study indicated that there were more than 112,000 kilometres of water mains in Canada with an estimated replacement cost of $34 billion. In addition, this study estimated that $12.5 billion would have to be invested over this 15-year period to replace existing (deteriorated) water mains and to construct new mains to service the projected growth.

Has the Sunshine Coast Grown Up?

Do 35,000 people really need 3 local governments?

Back in the 90s, the BC Government was in favour of amalgamation of the unincorporated areas of the Sunshine Coast, into one or more incorporated areas. This action would’ve given our remote area more autonomy into our own affairs. An example of this is the District of Sechelt, which governs a population greater than 5,000 people.

What was then known as the Sechelt Indian Government District would always remain outside of any other amalgamated areas, so they will not be considered a part of any restructuring conversation here.

BC Election 2024

Louis Hornung

For

Good Government

Do the Right thing!

We need to be an inclusive community, where everyone is represented equally, and fairly. We are all citizens of British Columbia, Canada, and as Canadians we need to show the rest of Canada, and the world, that we are, what being Canadian means; caring, just and fair.

We have endured decades of favouritism by all levels of government, and that is not what the Canadian Charter of Rights guarantees us. It’s time that we stand up for the right thing; equality!

BC Building Code 2025

Revising the BC Building Code to Protect Against Greed

Canada has a national building code, that sets the minimum standard for anything that falls under its jurisdiction. Each province may enact components that exceed the national standard, but that are pertinent to conditions found in that province. Most likely, every province has done this to meet and protect the needs of the people that it is responsible for.

Being a coastal province, BC would naturally experience different conditions than say, Manitoba. Some similarities might be consistent with mountainous areas in Alberta, outside of soil, precipitation, and ground water differences.

BC has had its share of loss, due to inadequate policies or allowances covered in the BC Building Code. The leaky condo situation would be one; while the sink holes of Sechelt would be another, or the landfill development site of Powell River. Everyone loses when the wrong thing happens.

Canadian Grocery Code

Canadian Grocery Code in Action

I typically visit a couple of different grocery stores twice a week, as some of the fresh produce doesn’t have much of a shelf life, and meal planning is subject to change without notice.

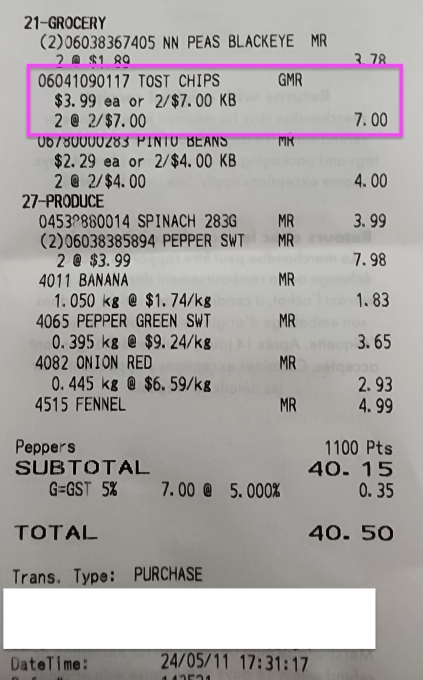

I purchased some Tostito Scoops on 2024-05-11, to go along with a fresh, spring vegetable dish that I planned on sharing with friends.

Six days later, I had the need to buy more Tostito Scoops, to take along with a second bowl of the dip, while we watched the Canucks playoff game.

Why is Canadian debt wrong?

Are the "Haves" forcing you to curb your lifestyle?

We have the Banking Act of Canada, that limits how far in debt any Canadian can go, based upon various tests against their income. If someone borrows outside of the banking system, they are on their own. Naturally, factors like developing a disability, or changes in family life are not a consideration for the opinion of this article.

If most Canadians are servicing their debt in agreement with the terms, why is it wrong that they have incurred the debt? If a family is building a future, that might include a recreational property, or recreational equipment, why has an environment been created that forces them to change a plan, because a renewal might make it unaffordable because of higher interest rates.

Raising the interest rates has done little to stop inflation, but it has forced some of the middle income group to cancel some of their plans and dreams, because they’re smart enough to not let things get out of control, other than the interest rates, that are out of their control.

Portable Automotive Battery

Imagine if all automakers shared a removable battery!

Once battery technology gets better, and smaller, like an owner replacable case, that sits in a relatively accessible location. You would never own the battery. It would be leased from a supplier that uses the exact same case design as numerous other suppliers. When you purchase a vehicle, it comes with an initial lease that is valid for a certain period of time; after that you would pay the supplier to lease the battery.

Rather than having a bunch of high power charge stations, with lineups to charge, and lengthy delays in resuming your travel, you would pull in to what could be a self-serve or manned location. A fully charged battery would be pulled from a bank of batteries that would replace the cases necessary in your vehicle, while the one(s) you brought would be placed in the charging rack.

$575 Billion in CPP Fund

Since the 1990s, it was predicted that the CPP fund for senior citizens of Canada would be extinguished to the point that it couldn’t be counted on to provide anything of value for a senior about to retire, if anything at all. Who started that fear mongering, or predicted the lack of vision that we now face?

Here we are in 2023, and the Federal Government has in the vicinity of somewhere over $575 Billion dollars in a fund somewhere noted as the CPP fund, or investment, and managed by the CPP Investment Board. When it’s somewhere over, is that like $150 Million over, or $600 Million over? How is it decided that a person who has worked for 40 - 50 years, contributing to this fund, should receive $717.15 per month if they retire at 65? What sort of return is that for a lifetime of contributions? Is that how we should thank Canadian seniors for their contribution to building and sustaining our Country?